Dear Friends and Associates,

We are on a capital raise campaign for our innovation accelerator which includes ear marking funds for OrthodontiCell LTP to advance these developments. Listed is the approximate budget, timeline and per share price that can be expected when achieving each milestone.

- Complete high production mold for mouthpieces = $110,000 > Summer 2020 > $10 per share

- Complete development of palm size at home use stimulator = $30,000 > Summer 2020 > $12 per share

- Publication peer reviewed journal of 2019 clinical pilot study and presentation at major meetings = $15,000 for travel > Summer 2020 > $23 per share

- Complete OPG stabilization pilot study = $40,000 > Summer 2020 > $25 per share

- Complete FDA 510K submission for mouthpiece = $45,000 > Summer 2020 > $35 per share

- Complete over aligners multi-center Phase II pivotal clinical study = $100,000 > Summer 2020 > $63 per share

OrthodontiCell www.orthodonticell.com

Leonhardt’s Launchpads www.leonhardtventures.com

OrthodontiCell Slide Deck > https://app.slidebean.com/p/692JLJZab2/05-08-2020

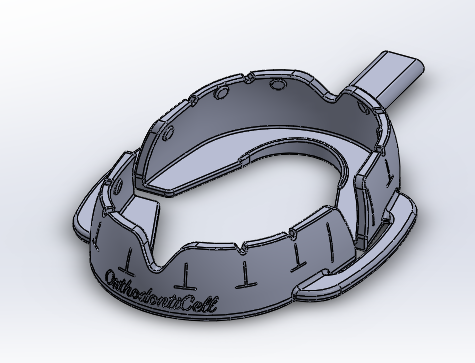

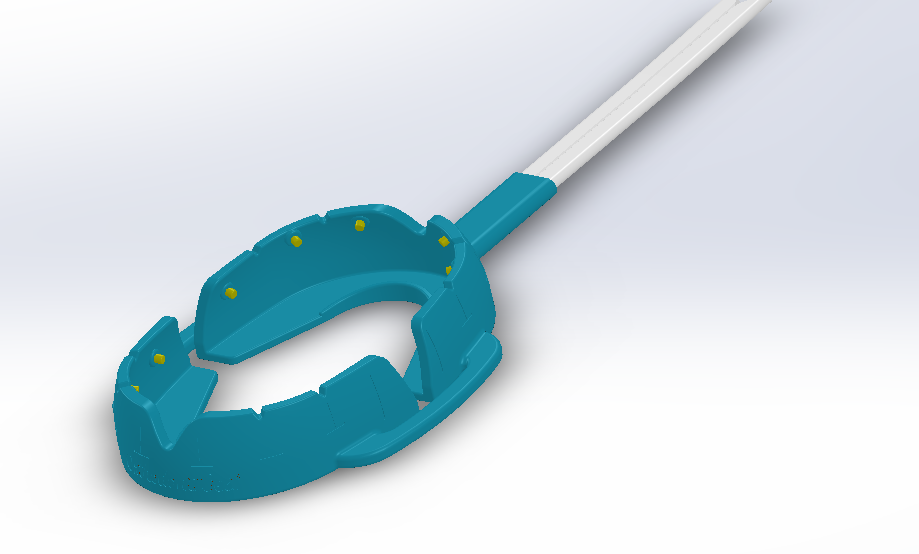

Elevator Pitch: OrthodontiCell has patented bioelectric controlled expression of RANKL and other key proteins for reducing the time of teeth straightening by up to 2/3rds compared to standard aligners or braces Additional we have patented OPG expression to stabilize teeth in their final positions after treatment in order to keep them straight with minimal use of retainers, reducing relapse (return to crooked teeth) from 30% to under 5%. Align Technology the teeth straightening aligner market leader peaked at $31 billion valuation recently even though their patents on the Invisalign product has expired. Smile Direct Club went public last fall at an $8 billion valuation with a copy cat of the Invisalign product.

OrthodontiCell completed a successful clinical study that demonstrated that the product met intended end point goals for accelerating tooth movement including a reduction of tipping which leads to relapse with braces and aligners. OrthodontiCell is now seeking a strategic partnership/acquirer to move its product to full commercialization. Our bioelectric stimulator already has FDA 510K and CE Mark market clearance for improving blood circulation and pain relief and can be marketed now for accelerated tooth movement under these cleared indications of use. OrthodontiCell has already had over a dozen meetings with potential strategic acquirers. We believe the OrthodontiCell product can straighten teeth 2/3rds faster than the current market leaders, with less pain and discomfort and has the only patented technology to keep teeth straight with minimal use of retainers after straightening. Only our technology is based on precise control of the proven biology of accelerated teeth straightening and stabilization. It is our strong prediction that the company that strategically acquires our IP will be the undisputed sales and profit leader in the growing teeth straightening market.

OrthodontiCell patent notice press release – Click Here and link to primary patent – Click Here. The final issued patent is schedule to be published July 5, 2020 with 20 years patent life from date of filing March 28th, 2017.

This means if you invest $30K you receive $30K worth of common stock shares of Cal-X Stars Business Accelerator, Inc. DBA Leonhardt’s Launchpads AND AT NO ADDITIONAL CHARGE $30K worth of ownership share units of OrthodontiCell LTP (Licensable Technology Platform) with pre-incorporation rights if converted from an LTP to a C corporation guaranteeing precisely same percent ownership. Note – In most cases we plan to sell or license innovations via Asset Purchase Agreements not via full corporation sales as is preferred by buyers and reduces cost, complexity and time so in most cases it is not anticipated that an LTP will convert to a C corporation before strategic sale. Wilson Sonsini Goodrich our M&A counsel has suggested that an Asset Purchase Agreement based sale model is the best model for us to stimulate a strategic acquisition deal to close quickly at less cost. The “assets” include all purpose specific IP, regulatory documents, data, SOPs, supply agreements and more but is primarily based on the IP value. OrthodontiCell LTP will convert on demand to OrthodontiCell, Inc. upon written request of any shareholder investing > $200K. All OrthodontiCell LTP stakeholders have pre-incorporation rights (PIR) to hold the exact same percentage ownership in the corporation as they held in the LTP at the time of conversion.

OrthodontiCell LTP Price Per Unit Ownership Share: $8

OrthodontiCell LTP Fully Diluted Valuation: $40 million with 5,000,000 total authorized shares

Leonhardt’s Launchpads by Cal-X Stars Business Accelerator, Inc. Price Per Share: $0.36585

Leonhardt’s Launchpads by Cal-X Stars Business Accelerator, Inc. Current Valuation: $21,664,135.90

Leonhardt’s Launchpads has about 32,122,000 conditional stock options pending and has total authorized 100,000,000 common stock shares and 150,000,000 preferred shares. All issuances to date of about 59,216,000 shares have been common stock only.

So by example if you invest $30,000 you will receive….

82,0001 common stock shares of Cal-X Stars Business Accelerator, Inc. DBA Leonhardt’s Launchpads

AND AT NO ADDITIONAL CHARGE

3,750 share units of OrthodontiCell Licensable Technology Platform (LTP) with pre-incorporation rights for 3,750 common stock shares of OrthodontiCell, Inc.

Owning shares of Leonhardt’s Launchpads by Cal-X Stars Business Accelerator, Inc. gives you partial ownership of all 30 innovation platforms/startups in our 2020 portfolio – Click Here. Valuations and unit share ownership information for all Licensable Technology Platforms and startups may be found here – Click Here password: Leonhardt.

The innovation accelerator business model is to seek a strategic partnership/acquisition via a milestone deal for each organ specific application of the core IP of the accelerator after first in human clinical study results one by one at a target pace of having ripe or near ripe for strategic partnership outreach efforts to begin approximately 5 startups a year over the next 6 years. A target tentative schedule of when each organ specific innovation may be most likely to be ripe to being strategic partnership discussions may be found on this web site page (highly subject to change) – Click Here

Here is a link to our Leonhardt’s Launchpads and Leonhardt Ventures 2020 Annual Report – Click Here a full April 3rd, 2020 PPM is attached. Here is our innovation and startup launch accelerator intro slide deck – Click Here.

Investor FAQs page from web site – Click Here and 2020 Target Goals – Click Here. Our innovation accelerator team – Click Here and advisory board – Click Here bios may be found here.

If anyone wishes to invest directly into OrthodontiCell instead of through the innovation and startup launch accelerator at an amount > $200,000 we will convert the LTP to a C corporation as a condition to closing to accommodate that investment which takes about 3 weeks processing time.

To set up a video telephone conference and slide presentation with the opportunity to ask questions of management please write to Mrs. Madyson McDaniel at madyworkmail@gmail.com our Office and Research Assistant based in Utah.

Kindest Regards,

Howard J. Leonhardt

Executive Chairman & CEO, Leonhardt’s Launchpads & OrthodontiCell LTP

Dr. John Marchetto

President and Chief Orthodontist Officer, OrthodontiCell LTP

This investment opportunity is restricted to accredited investors only that are sophisticated and have experience in investment in this sector. All potential investors are guided to read all the risk warnings found in our private placement memorandum, annual report and Investor FAQs page. Our product developments are early stage and most be considered to be a the highest risk of total loss. By design our innovation and startup accelerator shares resources and has substantial intermingling of assets amongst its portfolio of innovations and formative stage startups. If this is a concern to you this is not the investment for you. The core IP for nearly all the organ specific or purpose innovations (Licensable Technology Platforms) and formative stage startups is owned by Cal-X Stars Business Accelerator, Inc. DBA Leonhardt’s Launchpads or Leonhardt Ventures (Leonhardt Vineyards LLC DBA Leonhardt Ventures) both of which are controlled by founder and lead inventor Howard J. Leonhardt. Before entering these inventions into the accelerator Howard J. Leonhardt normally held 100% controlling ownership rights and he has agreed to give up at least 49.9% ownership rights for the benefit of being within the accelerator and in some cases, such as OrthodontiCell LTP, has given up over 70% ownership rights. We are attempting to achieve organ regeneration and accelerated healing results that have never been accomplished before at the same target level by any other group working in this area including those that have devoted substantially greater resources in attempting. It most be noted that even the most successful innovation and startup accelerators in the world, such as Y Combinator, have up to a 96% failure rate at providing substantial returns to investors from any given invention, innovation or startup.

Warnings and Disclaimers: Patents pending may not be issued. Patents issued, licensed or optioned may not be maintained. Products are early stage in development and are not yet proven safe or effective. Company lacks sufficient resources to bring these products fully to commercialization. As an investment these early stage startups have to be regarded in the highest risk category for total loss. Forward looking statements are subject to change without notice. Any timelines, implied or quoted, are highly subject to change even by years.

Statements in this press release regarding the efficacy, safety, and intended utilization of Leonhardt’s Launchpads or OrthodontiCell LTP product candidates; the conduct, size, timing and results of discovery efforts and clinical trials; scope, duration, validity and enforceability of intellectual property rights; plans regarding regulatory filings, future research and clinical trials; plans regarding current and future collaborative activities and the ownership of commercial rights; future royalty streams, and any other statements about Cal-X Stars Business Accelerator, Inc, Leonhardt Vineyards LLC DBA Leonhardt Ventures, or Leonhardt’s Launchpads Utah, Inc. management team’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “could,” “anticipates,” “expects,” “estimates,” “should,” “target,” “will,” “would” and similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements. More information about these and other risks that may impact our business are set forth in our 506D part C Cal-X Stars Business Accelerator, Inc. private placement memorandum originally filed in 2013 and updated via our Annual Reports (2020 Annual Report Link here > https://leonhardtventures.com/wp-content/uploads/2020/04/4_23_2020.pdf) and now a newly updated April 3rd, 2020 private placement memorandum. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we assume no obligation to update these forward-looking statements. Additional information may be found on our Investors FAQ page https://leonhardtventures.com/frequently-asked-questions/. To receive current estimated valuations for each of our organ specific Licensable Technology Platforms (LTPs) or formative stage startups please email howard@leonhardtventures.com to receive password access to our listing page.